Trading Psychology

Trading psychology is the study of the psychological factors that influence a trader’s decision-making and behavior in the financial markets. It is an important aspect of trading and investing, as psychological factors can have a significant impact on the success or failure of a trade.

Some of the psychological factors that can affect a trader’s decision-making and behavior include:

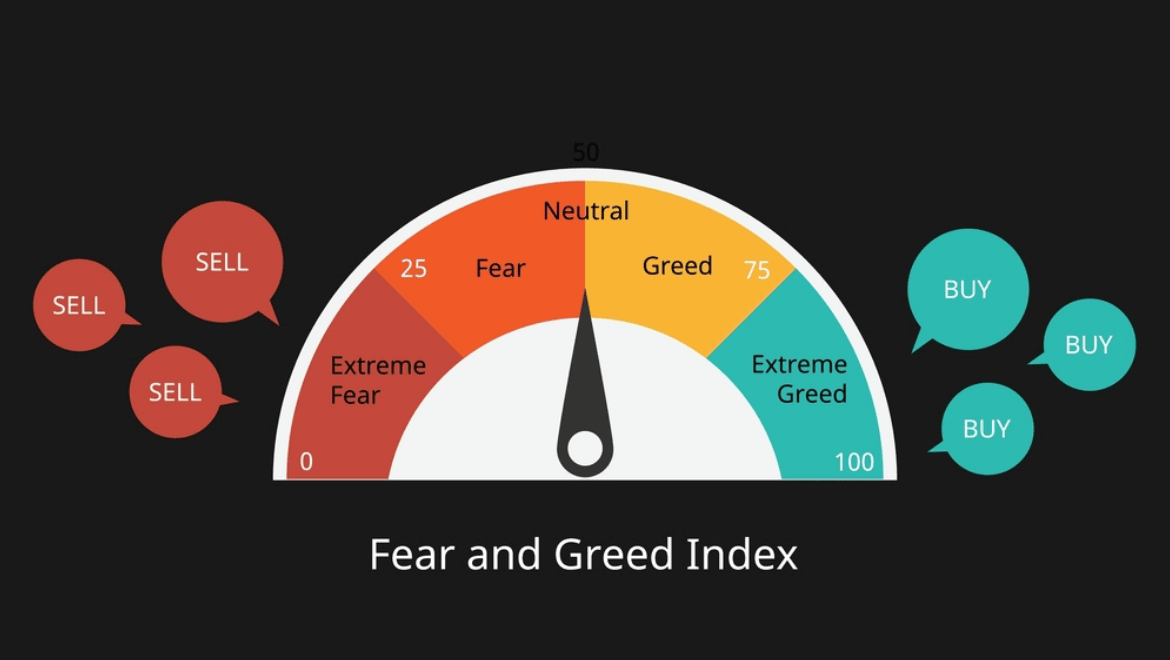

- Emotions: Emotions such as fear, greed, and hope can influence a trader’s decision-making and risk-taking behavior. For example, fear of losing money can cause a trader to sell prematurely, while greed can cause a trader to hold onto a losing trade for too long.

- Cognitive biases: Cognitive biases are mental shortcuts that can distort a trader’s perception of reality and lead to irrational decision-making. Examples of cognitive biases include overconfidence, confirmation bias, and the sunk cost fallacy.

- Trading style: A trader’s personal trading style, such as whether they are a conservative or aggressive trader, can also influence their decision-making and behavior in the markets.

To manage the psychological factors that can influence their trading, traders can use a variety of techniques, such as:

- Developing a trading plan: A trading plan is a written set of rules and guidelines that outline a trader’s approach to the markets. It can help to provide structure and discipline to a trader’s decision-making and can serve as a reference point in times of uncertainty.

- Using risk management techniques: Risk management techniques, such as setting stop-loss orders and using position sizing, can help to limit the potential impact of psychological factors on a trader’s risk-taking behavior.

- Seeking education and training: Trading education and training can help traders to develop the knowledge and skills needed to make informed and rational decisions in the markets.

- Seeking support: Seeking support from a mentor, coach, or peer group can also be helpful in managing the psychological challenges of trading.

Overall, trading psychology is a critical aspect of trading and investing, and it is important for traders to understand and manage the psychological factors that can influence their decision-making and behavior in the markets. By using techniques such as developing a trading plan, using risk management techniques, seeking education and training, and seeking support, traders can better manage the psychological challenges of trading and improve their chances of success.